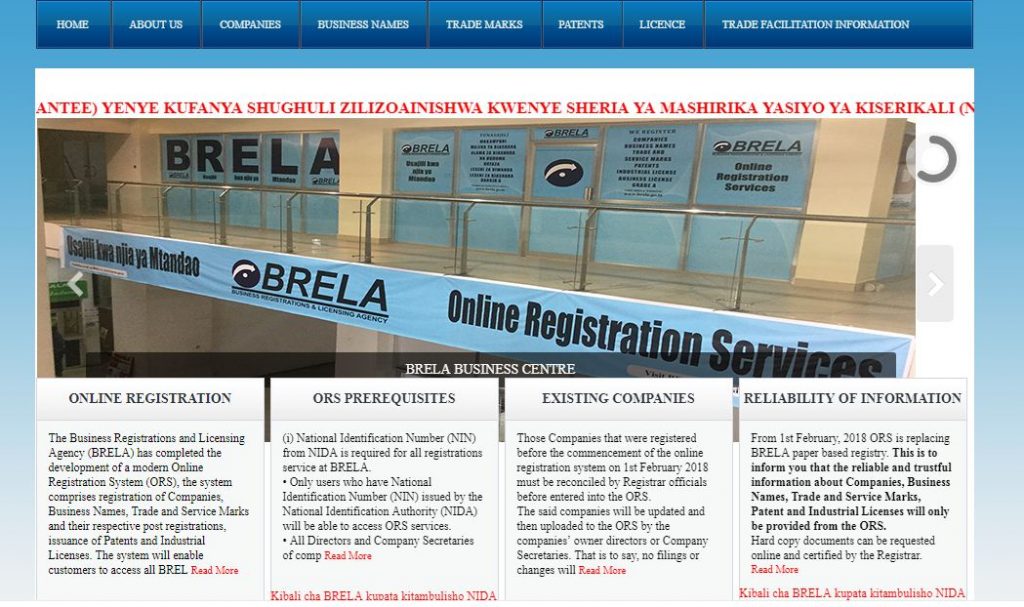

The registration of a business name and company in Tanzania involves several processes, documents and government institutions. The Business Registration and Licensing Agency (BRELA) is the institution that deals with all the company incorporations in Tanzania.

In 2018, BRELA completed the development of a modern Online Registration System (ORS). It is a portal for online company registration in Tanzania.

The system enables customers to access all BRELA services wherever they are without visiting BRELA premises, at any time of the day.

Summary of Cost of Registration of Company in Tanzania

| PARTICULARS | COST IN TZS |

|---|---|

| Business name registration | 5,000 |

| Company registration | Starts from 95,000 |

| Tax Identification Number (TIN) | Free |

| Certificate of Incorporation | 337,200 |

| Business license | 400,000 |

| OSHA Registration | 600,000 |

The processes to register company in Tanzania is as follow:

How to Register a Business Name in Tanzania

- You first need to conduct a name search by applying for the proposed business name by submitting three names to make sure your proposed business name has not already being registered.

- If successful, you can reserve the name for future use or go ahead with company incorporation.

- A business can be run under a business name (sole proprietor) without having to incorporate a company.

Company registration (local companies)

- Application for a certificate of incorporation is done at the Business Registration and Licensing Agency (BRELA).

- The director, a subscriber or company secretary must submit the following to the Registrar of Companies: form 14a, form 14b and memorandum and articles of association.

Company registration (foreign companies)

- Foreign branches (companies) are required to submit the certified copies of the memorandum and articles of association of the parent company.

- Notice of the location of the registered office in the country of domicile.

- List of directors and names of the representatives in Tanzania.

Once you get the certificate of incorporation you need the following:

- Tax Identification Number (TIN).

- Business license.

- Value Added Tax identification number (VAT).

- Workers Compensation Fund.

- Social Security registration.

- Occupational Safety and Health Authority (OSHA) registration.

Tax Identification Number (TIN)

After getting a certificate of incorporation, you will need to apply for a TIN certificate from the Tanzania Revenue Authority (TRA).

- Certified copies of certificate of incorporation and memorandum and articles of associations shall be attached to the TIN application.

- TIN application for each shareholders/directors. If any director has already been issued with TIN certificates for other purpose he/she cannot make another application so the same TIN number will be used.

- At least one of the directors of the company must be physically present at the tax office for processing of biometric data. The applicant must visit TRA offices to pick up the TIN number in person.

- Directors/ Shareholders passport copies and photos.

- The company will be required to declare its estimated income or turnover for the provision tax assessment for the particular year.

Business License

Application for a business license is done at the Ministry of Trade and Industry or the Local Government Authorities. The process takes up to 3 working days.

Documents needed

- Proof of a suitable company premises.

- Taxpayer Identification Number (TIN) (acquired through the process outlined above).

- Certified copies of the memorandum and articles of association.

- Certified copy of a Certificate of Incorporation.

- Certified copy of a TIN certificate.

- Certified copy of the Tax Clearance obtained from the Tanzania Revenue Authority.

- Certified copy of the Lease Agreement (stamp duty and witholding tax paid) for the company office.

- Directors/ Shareholders passport copies.

Value Added Tax (VAT)

VAT is obtained from the Tanzania Revenue Authority and for the purpose of obtaining a VAT one must fulfill the following requirements:

- Tanzanian businesses with initial capital of 50 millions shilings for the first six months of a business or 100 millions shillings in a year are required to register for value added tax.

- To register for VAT you need to go to TRA office or register online.

Documents needed

- Certified copy of a TIN certificate.

- Certified copy of the tax clearance certificate.

- Certified copy of a business license.

- Certified copy of the memorandum and articles of association.

- Certified copy of a certificate of incorporation.

- Purchase of an Electronic Fiscal Device (EFD).

- Certified copy of lease agreement for the office.

- Directors/ shareholders passport copies.

Workers Compensation Fund

Worker Compensation Fund provides wage replacement and medical benefits to employees injured in the course of employment. To register for the fund, employers need to do the following:

- Register once the company begins hiring employees and just before the firm becomes operational.

- Complete the Workmen’s Compensation Tariff Proposal Form at Workers Compensation Fund (WCF) and Tanzania Insurance Regulatory Authority (TIRA).

- Employers may opt to take an insurance policy instead of the workers compensation.

Social Security

- Every employer in the formal sector is required to register the National Social Security Fund.

- The employee has the right to choose the mandatory scheme to register under.

OSHA

- You must must register with the Occupational Safety and Health Authority (OSHA) by completing the application form and provide the company registration documents.

- OSHA officials visit the workplace prior to you applying for inspection and health safety.

Conclusion

After going through Tanzania company registration, you need to meet additional licensing requirements based on your industry. You need to find out license requirements in your industry.

Companies that were registered before the launch of the Online Registration System (ORS) on 1 February, 2018 must be reconciled by Registrar officials before entered into the ORS. Those companies will be updated and then uploaded to the ORS by the companies’ directors or company secretaries.

You should make sure that your company meets compliance standards by updating annual returns of the company, paying corporate tax and VAT where applicable, income tax for employees and make contribution to social security for employees.

tanzania company registration

Tanzania is ranked 144 among 190 economies in the ease of doing business, according to the World Bank.

![How to Patent an Idea [Kenya, Tanzania, Ghana, Nigeria, South Africa, Zambia]](https://businessideas4africa.com/wp-content/uploads/2020/11/patent-300x200.jpg)