Political stability and the presence of extensive infrastructure make Namibia perfect for business. Additionally, its business-friendly legal and regulatory framework, sound financial system, and stable foreign exchange reserves attract local and foreign investors.

Company registration in Namibia can be done both manually and online. Company registration is done with the Registrar of Companies within the Ministry of Trade and Industry. The Business and Intellectual Property Authority (BIPA) was established to improve service delivery in the registration of business and industrial property.

Types of Businesses in Namibia

Before registration, you need to decide on the type of business you want to set up. It all depends on whether you intend to make profit or not. You can choose to register the following;

- A Company. This is a complex business structure that operates as a separate legal entity.

- A Sole Proprietorship or Defensive Name. This is basically a one-person business where he/she receives all profits, and in case of losses, the owner is fully liable for all debts incurred.

- A Close Corporation. It is a type of business that can have 1-10 owners whose interest is indicated in percentages.

Types of Companies in Namibia

The following are the types of companies in Namibia;

- Private Limited Liability Company

- Public Limited Liability Company

- Non-Governmental Organizations/Section 21 Companies

- External/Foreign Company

How to Register a Company in Namibia Online

In order to create an enabling and friendly business environment, the government of Namibia has a created a Citizen Center portal that allows you to register a company in Namibia online from anywhere in the world. This can be done by both Namibians or foreigners. You can also conduct BIPA name search online as well as conduct application status check.

Company Registration in Namibia

The procedure for company registration in Namibia is similar across the different company types. However, you might need to fill out slightly different registration forms for different company types.

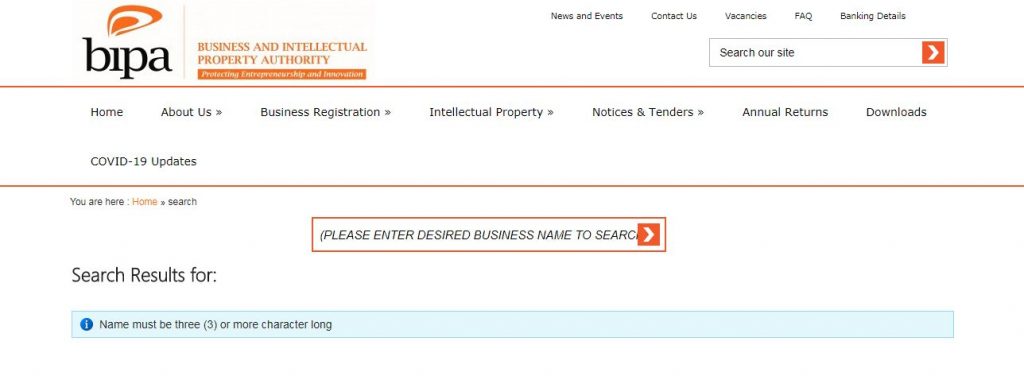

BIPA Name Search

Once you decide on the type of company you want to set up, you will need to decide on a name that your business will be identified with. You can conduct a name search on the BIPA website to ensure that your proposed company name is already in use. Upon approval of the proposed name, you can apply for its reservation.

Apply for Name Reservation

Company name reservation is done with the Business and Intellectual Property Authority (BIPA), an agency under the Ministry of Industrialization, Trade and SME Development (MITSMED). You can apply at any BIPA office or online. A business name is usually reserved for 60 days. Here are BIPA name reservation forms.

Apply for a Certificate of Incorporation in Namibia and Certificate to Commence Business

Once your proposed company name is approved, you can apply for a Certificate of Incorporation (CM1) and a Certificate to Commence Business (CM46). You will need to submit certain documents/ registration forms attached to your application.

Company Registration Forms in Namibia

When registering a company in Namibia, you will need to fill essential details on different company registration forms. The following are the registration forms for the different types of companies.

Private, Public and Section 21 Companies

When registering private (proprietary) Limited, Public (Limited), and Section 21 Companies, you will need to submit the following forms and pay the relevant filing fees.

- Memorandum and Articles of Association in triplicate of forms CM3, CM4, CM44B, and CM44C.

- A copy of the approved name on form CM5

- Notice of company postal and physical address on form CM22

- List of Directors, Auditors and Public Officers on form CM29

- Appointment of an Auditor on form CM31

- A request for submission of additional Copies on form CM51

Foreign Companies: Starting a Business in Namibia as a Foreigner

The application for a Certificate to Commence business (CM46) for foreign companies requires that you submit all the forms mentioned above together with the following additional forms.

- Alteration to Memorandum of External Company on form CM39

- Application of Certificate of Registration of Memorandum of External Company on form CM49

- Statement by each Director regarding the Adequacy of Company share Capital on form CM47

Documents/Forms and Fees

| Fee in Namibian Dollars(ND) | |

|---|---|

| CM5 in duplicate | 5.00 |

| Power of Attorney | 5.00 per person |

| CM22 in duplicate | 2.00 |

| CM29 | 2.00 |

| CM46 | 10.00 plus Annual Duty |

| CM47 by each Director | Submitted with a Revenue Stamp of 2.00 |

| CM31 in duplicate | 2.00 |

| CM23 | Minimum of 80.00 depending on your issued capital |

Post-Registration Obligations

Following the successful registration of a company in Namibia, it is essential to ensure compliance with other relevant institutions such as;

The Ministry of Finance for the Registration of Value Added Tax and Company Tax

It is essential that all businesses register for tax. There are special tax schemes for all types of companies in Namibia; therefore, the tax rate can fluctuate. Businesses making taxable supplies with a threshold of 500,000 Namibian Dollars (NAD) or expected to meet this threshold in 12 months are obliged to register for VAT. Foreign companies with a turnover above 200,000NAD should register for income tax. Value Added Tax on goods and services ranges between 0% and 15%.

Zero-rated supplies include international transport, funeral undertaking services, flour and bread, leaded and unleaded petrol, and the export of goods.

VAT exempt supplies include education services, supplies to heads of foreign states, financial services, medical and paramedical services, etc. All businesses that register with the Ministry of Industrialization, Trade and SME Development are automatically registered for tax.

The Ministry of Home Affairs for Application of Work Permits and Visas

Any foreigner planning to establish a business in Namibia will need to obtain work permits and visas. The type of work permit to apply for depends on the length of time the employee will work in the country (work visa; maximum of 3 months and work permit; 1 to 3 years). Foreign business owners from countries with a visa exemption agreement with Namibia are issued free business visas on arrival while other foreigners must arrange a visa in advance. The Ministry of Home Affairs is responsible for the issuance of work permits in Namibia.

The Social Security Commission

Companies carrying out activities in Namibia need to pay certain social security taxes to the Commissioner of Social Security. Both employers and employees contribute 0.9% up to a maximum remuneration of NAD108, 000 per year. The Social Security Commission is involved in collecting contributions, registration of employers and employees, and investment of funds.

The Ministry of Labour

All companies in Namibia should be compliant with the Ministry of Labour provisions, which relate to working time, wages, and the employment of vulnerable groups of workers. The ministry supplies technical information to employers and workers concerning the most effective means of complying with the law.

Conclusion

Doing business and investing in Namibia is one of the best decisions you can make as it offers unique advantages to investors and business people. You need to reflect on your investment needs and take the next crucial step into establishing your business.