Ghana’s economy mainly relies on agriculture, petroleum, natural gas, and mining. It has large deposits of gold and diamonds and is the 2nd largest cocoa producer in the world. You may want to start a business that revolves around these economic strongholds. Let’s dive into how to start and register a company/business in Ghana.

How to Start a company in Ghana

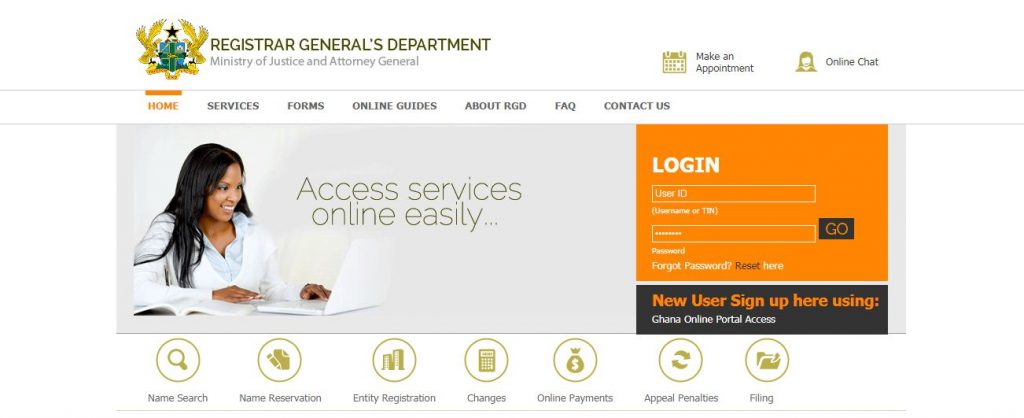

If you want to start a company/business in Ghana, the first steps include conducting market research, writing a business plan, sourcing for business finances, picking a business location, choosing a business structure, and choosing a business name. After following these steps, you will need to register the business entity under the laws of Ghana at the Registrar General’s Department (RGD) offices or visit the RGD online portal. It is vital to choose a legal structure that suits your business goals. The following are forms of business entities to choose from.

- Companies Limited by shares: shares of the company are not offered to the public. A Board of Directors does company management.

- Companies Limited by guarantee: there is no share capital and no directors. They are mainly formed for non-profit organizations.

- Companies with unlimited liability: made up of two directors and other members who own shares in the company. The liability of shareholders is not limited to the unpaid amount on their shares.

- External Company: this is a company formed outside of Ghana and seeks to register a business in Ghana.

- Incorporated Partnership: is a company formed when a group of people join to develop a business. It can range from two to twenty people.

- Sole Proprietorship: Is a company/business owned and managed by a single person. It is convenient for a small enterprise.

How to Register a Company in Ghana

The process given shows steps for company registration, which might differ slightly for different business entities. For smooth registration, get all the required forms from the RGD offices or website.

Search and Apply for Reservation of a Business/Company Name

Searching for a Company Name is conducted at the Registrar General’s Department offices in Ghana. Your proposed Business Name must be relevant to the type of business you want to engage in, must not be offensive, and must also follow all trading rules. The Department will reject any similar names. Upon a successful name search, apply for reservation of the business name. A reserved name is usually valid for 30 days.

Registration of Tax Identification Number (TIN) for all Participants

When registering a business, all company directors, secretary, auditors, process agents, and shareholders need to complete TIN registration forms and attach copies of Photo IDs (passport bio-data, driver’s license, voters ID). When a corporate entity holds shares of a company being registered, a TIN is necessary for that corporate organization. The organization will fill in a TIN registration form and attach a letter of introduction.

Suppose you decide to register more than one business entity or serve as a director in several organizations. In that case, you will be required to have one TIN for all your registered businesses. Taxpayer Identification Numbers are created within 1-3 days at any Ghana Revenue Authority Office or the GRA Online Portal. Registration is free. The details required to complete an individual TIN form includes name, occupation, photo ID details, mother’s maiden name, residential and postal address, and contact details.

Complete your RGD documents (Form 3, Form 4 and Company Regulations)

After registration of the Taxpayer Identification Number, download and complete Form 3(Returns of Particulars of the company), Form 4 (company registration), and regulations of a private company limited by shares. The information required to complete the documents include company name, registered address, postal address, principal place of business, business objectives, contacts, auditors details, stated capital, authorized and issued shares, shareholding structure, and personal information (nationality, date of birth, occupation and residential address) of directors, secretary, and shareholders.

During the company registration process, a company must have at least two initial directors and a secretary (according to the Companies Act 179). At least one company director or the secretary must be resident in Ghana. The completed forms must have the directors, secretary, and shareholders signatures on relevant pages before submission.

Registrar General Digital Address System

Businesses wanting to register at the Registrar General’s Department must have a digital address concerning their business units. This enhances compliance by Registrar General Department, debt recovery by banks, and paying of taxes by GRA.

Pay Stamp Duty, Business Incorporation and Filing Fees

Upon completion and signing of all required documents, they are submitted to the RGD for payment of filing fees and the capital duty. For companies with joint foreign ownership or 100% foreign ownership, there are different stated capital requirements.

Collect Business Registration Certificates

After payment of filing fees and capital duty, the documents are verified and filed at the RGD. You will receive an original certificate of incorporation, certified true copies of Form 3, Form 4, the Company regulations, and a certificate to commence Business in a few weeks. In case the certificate to commence Business is not issued, the company should obtain a specific Business Operating Permit at the Metropolitan Authorities. These documents are a sure proof of a company’s/ business’ existence in Ghana.

Apply for Business Licenses at the Metropolitan Authority

The registration fees for a business license depend on the type of business and the category in which it falls. Different types of enterprises will submit different documents. For example, a restaurant will submit permits from the Fire department. Licenses are obtained from the Ghana Metropolitan Authority/Assembly.

Apply For Social Security

The application for social security is made at the Social Security Office. The company will need to attach a list of employees, salaries, social security numbers, the company’s Certificate of Incorporation, and Certificate to Commence Business.

Filing Annual Returns for the Company

After receiving all required documents to commence your Business, it is good to know that Section 122 of the companies Act, 1963 requires all registered companies to file annual returns each year. This should be done after 18 months of incorporation. Requirements for filing annual returns are:

- A complete annual returns form from the Registrar General’s Department

- An audited Financial Statement for the year. It must be signed and approved by Company Directors

- A fee of 50 Cedis

Making Changes or Amendments after Company Registration

After completing a company’s registration in Ghana, the shareholders may decide to make some changes of Directors, share transfer, business name, activity, business address, or an increase in the stated capital. All changes must be made at the Registrar General Department. There are forms to be signed depending on the nature of change and written resolutions prepared by the company secretary and signed by Directors and shareholders.

How to Register a Business Online in Ghana

The introduction of online company registration in Ghana has made it easier to do business. You do not have to visit the Registrar General’s Department offices to register your business/company. You can download all business registration forms from home. The Registrar General’s Department Online Portal provides online services such as Name Search, Name Reservation, Name Reservation Extension, Entity Registration, Entity Registration With Tin/Old Tin, Commence Business, or a Change in Particulars.

How Much Does It Cost to Register a Company in Ghana?

The Registrar General’s Department (RGD) provides business registration services. Companies must file their annual returns and other statutory forms and resolutions according to the business’s growth and changes. The following are the costs for registering companies in Ghana.

| Business type | Process | Charges in Cedis |

|---|---|---|

| Sole Proprietorship | 50, 10 respectively | |

| Filling Form D | 25 | |

| Annual Renewal | 25 | |

| Partnership | Registration of Partnerships, Certified True Copy (CTC) | 150, 10 respectively |

| Annual Reward | 50 | |

| Change of Name | 110 | |

| Filing Form B | 50 | |

| Filing of Memoranum of Satisfaction for Registration | 60 | |

| Company Limited by Shares | Name Search | 25 |

| Name Reservation | 50 | |

| Incorporation of a Company, CTC | 200, 30 respectively | |

| Filing Form3 & 4 | 100 | |

| Stamp Duty (0.5% on stated capital) | ||

| Filing of Annual Returns | 50 | |

| Change of Name by Resolution, CTC | 100,10 respectively | |

| Filing Form 17, CTC | 50, 10 respectively | |

| Filing Form 15, CTC | 50, 10 respectively | |

| Filing Form 9, CTC | 50, 10 respectively | |

| Filing Form 13, CTC | 50, 10 respectively | |

| Filing Special Resolution Form, CTC | 50, 10 respectively | |

| Deed of Transfer, CTC | 50, 10 respectively | |

| Filing Form 6, CTC | 50, 10 respectively | |

| Filing Form 7, CTC | 50, 10 respectively | |

| Filing Form 8, CTC | 50, 10 respectively | |

| Company Limited by Guarantee | Name Search | 25 |

| Name Reservation | 50 | |

| Incorporation of a Company, CTC | 200, 20 respectively | |

| Filing Form 3 | 50 | |

| Annual Returns | 50 | |

| Change of Name by Special Resolution, CTC | 100, 10 respectively | |

| On conversion of a Company Limited by Shares to a Company Limited by Guarantee | 250 | |

| Filing Form 17, CTC | 50, 10 respectively | |

| Filing Form 15, CTC | 50, 10 respectively | |

| Filing Form 9, CTC | 50, 10 respectively | |

| Filing Form 13, CTC | 50, 10 respectively | |

| Filing Special Resolution Form, CTC | 50, 10 respectively | |

| Deed of Transfer, CTC | 50, 10 respectively | |

| Filing Form 6, CTC | 50, 10 respectively | |

| Filing Form 7, CTC | 50, 10 respectively | |

| Filing Form 8,CTC | 50, 10 respectively | |

| External Company | Company Registration | US dollars 1200 |

| Registration of Group Accounts | US dollars 600 | |

| Filing of External Company Documents | US dollars 250 |

Conclusion

For fast business registration, make sure to provide complete information on the registration forms. Incomplete information and misinformation will delay the process. Following the right legal procedures in registering a company in Ghana will help business owners run their businesses without legal complications.

![How to Grow Hemp for Industrial and Medicinal Use [Beginner’s Guide]](https://businessideas4africa.com/wp-content/uploads/2020/11/vpfehvi5ue4-scaled-300x200.jpg)

![How to Patent an Idea [Kenya, Tanzania, Ghana, Nigeria, South Africa, Zambia]](https://businessideas4africa.com/wp-content/uploads/2020/11/patent-300x200.jpg)